For years, you’ve been working toward the eight-figure exit. You’ve finally received a letter of intent and you’re ready to sit down at the table to negotiate the sale of your Registered Investment Adviser (RIA) firm. It’s one of the most exciting times of your life but the timing couldn’t be worse. Recent or pending litigation could turn one of your biggest moments into an anxiety-inducing nightmare. Disclosing litigation to a potential buyer may be the last thing you want to do, but it doesn’t have to mean your dream of selling is over.

Follow Along With The Financially Simple Podcast!

This week on The Financially Simple Podcast:

-

(01:24) Industry-Specific Risk

-

(05:07) The SEC Litigation Release

-

(08:03) Two Areas You Must Separate

-

(12:19) How Do You Deal With Litigation During the Eight-Figure Exit?

-

(14:47) Representations & Warranties

-

(15:41) Disclosure Schedules

-

(18:56) What Are the Best Action Steps You Can Take?

-

(21:57) Read Your Contracts

The “L” Word: Litigation in the RIA Industry

As an RIA owner, you’re undoubtedly familiar with the myriad risks that come with running your own financial advisory business. These risks can range from market fluctuations to regulatory changes. But today, I want to zero in on one very specific concern: litigation. Litigation, or the threat of it, can have a profound impact on your ability to achieve that coveted eight-figure exit. Moreover, understanding when you are required to disclose current, pending, or past litigation to a potential buyer is crucial when working toward the eight-figure exit.

You see, of all the things that keep business owners up at night, uncertainty is king. It’s normal for us to fear the unknown. As business owners, we often fear the things that are outside of our control. The risks that come with owning a business are often out of our control. We can do many things to mitigate them or shield ourselves from them. But inevitably, the risk of litigation is a clear and present danger.

I have a long-time client whose business had a unique and specific risk. His crew would often do work alongside busy stretches of highway, and his biggest fear—the thing that kept him up at night—was that one of his team members would step onto the road and be hit by a vehicle. I can remember when he was approaching his exit, how he prayed that none of his team would be harmed. Of course, he genuinely cared for their well-being, but he also understood that it would create a potential for litigation.

Now, in the RIA space, we often worry about receiving a client complaint and the legal issues that could arise from it. So, what do you do if you find yourself being litigated? What if you’re approaching your exit? Ultimately, how do you disclose litigation to a prospective buyer? Before we dive into the meat of our topic, let’s have a look at some of the numbers surrounding mergers and acquisitions (M&A) and litigation within the RIA space.

Litigation and RIA Mergers & Acquisitions

Friends, let’s start off with some recent data around M&A in the RIA space. Between January and July of 2023, the industry has seen 120 M&A deals. This represents a noticeable dip from the 264 deals observed in 2022. Despite slower M&A movement, there are still plenty of businesses changing hands. Each of these deals means disclosing litigation, whether it be past, present, or pending. But what do we know about litigation across the industry?

Over half of Investment Advisor Representative (IAR) disclosures in the RIA industry stem from consumer complaints, according to the Investment Advisor Association’s Investment Advisor Industry Snapshot 2022. Consumer-initiated arbitration or civil litigation accounts for a substantial portion, standing at 11.1%. Additionally, 1.8% of disclosures involve a criminal conviction, shedding light on the diverse array of legal issues that can plague an RIA.

The Securities and Exchange Commission (SEC) has been actively involved in pursuing litigation against RIA firms and IARs. In 2022, the SEC brought litigation against 306 such entities. Folks, I know that may seem like an insignificant number in the greater context of how many RIAs there are, but this is only referring to actions by the SEC. The Commission has continued this pursuit in 2023, with 238 cases reported thus far. Additionally, the Financial Industry Regulatory Authority (FINRA) collected $54.5MM in fines and $22.2MM in restitution in 2022. Friends, these numbers underscore the regulatory scrutiny facing the RIA industry.

Common Reasons for Litigation

So, now we know that there is a very real possibility that RIA firms could be in the midst of active or pending litigation. Likewise, M&A transactions are continuing across the industry, even if they’ve slowed down a bit. Friends, we’re building up to the hows, whens, and whys of disclosing litigation during a business sale, but first, let’s look at some common reasons litigation takes place in the RIA space.

First, there’s negligence. By failing to act in a manner that reasonably protects clients from financial risk or harm, you could find yourself on the wrong side of a negligence claim. You can avoid this by being diligent in managing client accounts and listening to their needs.

Next, we have a breach of fiduciary duty. Look, I truly believe the vast majority of advisors are in it to help people. However, there are bad actors in every group. Any actions that prioritize the advisor’s interests or the RIA’s interests over those of the investor can constitute a breach of fiduciary duty. This should result in litigation every time.

Finally, there are contractual disputes. The RIA space frequently witnesses contractual breaches. These can occur between advisors and clients, RIAs and custodians, you and your own team members, or even past employers. For instance, if you left a wirehouse and used their proprietary tools or information to grow your own practice, you could be in breach of contract, depending on the terms. In the words of Max Schatzow, a partner at RIA Lawyers, “Most employers in this industry still try to protect their business and their clients through restrictive covenants, and when employees violate those restrictive covenants, we oftentimes see litigation.”

Disclosing Litigation to the Buyer

When it comes to industry-specific risk, financial advisors often have client-facing risks or the risks associated with serving each of their clients. Because of this, we have Form U4. With it, each advisor in your firm is required to disclose certain events, such as criminal convictions, regulatory actions, customer-initiated actions, etc. Therefore, as financial advisors, we often take pride in having a “clean” U4. But mistakes happen, and sometimes you end up with a disclosure on your U4.

According to the Investment Advisor Association’s Investment Advisor Industry Snapshot 2022, 16.8% of IARs make disclosures on Form U4. Out of those advisors with disclosures on their U4, 85.9% have to do with client complaints. So, it’s possible that one of the IARs in your RIA, has a U4 disclosure that could be discovered as you attempt to make the eight-figure exit. However, your firm’s business risks could also be a factor.

You see, litigation comes in many different flavors. From wrongful termination suits to a breach of contract, owning a business can feel like you have a target on your back. So, as we’re discussing the eight-figure exit, and you’re doing all that you can to make it a reality, there will be plenty of things that can keep you up at night. So, how do you disclose litigation as you prepare for your exit?

Friends, this is the reason we’re here today. Disclosing litigation can be difficult when you’re on the verge of an eight-figure exit. You don’t want to do anything to disrupt or derail your goal. However, a failure to divulge this pertinent information could do that and more.

The Importance of Disclosure

When it comes to selling your RIA, transparency is paramount. You’re not going to “outsmart” the buyer. That’s just not going to happen. But why? There will likely be a Representations and Warranties section in the purchase agreement. In this section, both the buyer and seller make assertions and assurances about the business being sold. However, seller representations and warranties typically carry more weight.

This is your opportunity to disclose any past, pending, or active litigation related to your RIA. Attempting to conceal such information could backfire during the due diligence process. If the buyer discovers undisclosed litigation, it could sour the relationship and jeopardize the sale. Worse yet, acting in bad faith could lead to a secondary lawsuit from the buyer.

The Role of Disclosure Schedules

Disclosure schedules play a pivotal role in the purchase and sale agreement. They supplement the agreement by incorporating specific disclosures about the business. These schedules usually fall into two categories: List Schedule and Exception Schedule.

- List Schedule: This asserts that the schedule contains a complete record of certain aspects of the business. For example, it might list all registered intellectual properties or employee benefit plans.

- Exception Schedule: In contrast, an Exception Schedule allows the seller to qualify a representation made in the purchase agreement, limiting potential liability. It shifts some risk from the seller to the buyer.

Some of you are reading this and saying, “Okay, Justin, why does it matter?” Well, as I said, this shifts some of the risk from you to the buyer. However, if a buyer truly wants your business, they will likely negotiate some form of indemnity to cover the litigation.

For example, let’s say that you were sued for breach of contract by an employee, whatever the contract breach was, and the employee sued you for a million dollars and you’re trying to sell your business for $10 million. The buyer will read about the litigation in your disclosure. If you’re open and honest about current or pending litigation, there are things that can be done to continue the deal. For example, the buyer may have a million dollars held back in escrow versus giving it to you so they know that they have funds held back to deal with the complainant.

The Best Defense

Look, being a business owner is inherently risky. This is especially true in the RIA space. After all, we’re in one of the most highly regulated industries in the world. But just because you understand that there is risk involved doesn’t mean you have to simply “accept your fate.” No. There are many things you can do to mitigate that risk. Ultimately, the best defense against litigation is to not be named in a legal action. So, what can you do to avoid litigation?

- Create a Culture of Compliance: Foster a work environment that prioritizes regulatory compliance. Following the guidelines laid out by the SEC and FINRA will go a long way in helping you avoid many types of legal action.

- Adhere to Your Fiduciary Duty: Always act in the best interests of your clients. Act in transparency and divulge any possible conflicts of interest.

- Choose Clients Wisely: Be discerning when taking on high-risk clients. Look for “red flags” during your introductory conversation. If they’re not forthcoming or refuse to divulge financial information, it’s probably best to stay away.

- Consult Legal and Insurance Professionals: Collaborate closely with attorneys and insurance agents to safeguard your firm.

- Invest in Training and Supervision: Ensure that your team is well-trained and supervised to minimize errors and omissions.

- Respect Contracts: Have your attorney review all contracts and follow them closely. This should be your standard practice whether it’s employee contracts, client contracts, or even privacy and non-compete clauses with previous employers.

- Protect Client Data: Take stringent measures to safeguard client data against breaches and cyberattacks.

By taking these precautions, you can reduce the likelihood of litigation and safeguard your RIA’s reputation, value, and ultimately, your own financial future.

Wrapping Up…

Friends, I know that litigation isn’t a fun or sexy subject. However, I want you to achieve the eight-figure exit so you can live the life of your dreams. Therefore, it’s vital that you understand the importance of disclosing litigation to potential buyers. But it’s also important that you begin working through your exit plan as early as possible. Part of that plan should involve diversification outside of your RIA. If all your eggs are in this one basket, you could miss out on the eight-figure exit if you’re unfortunate enough to be involved in pending litigation at the time of your sale.

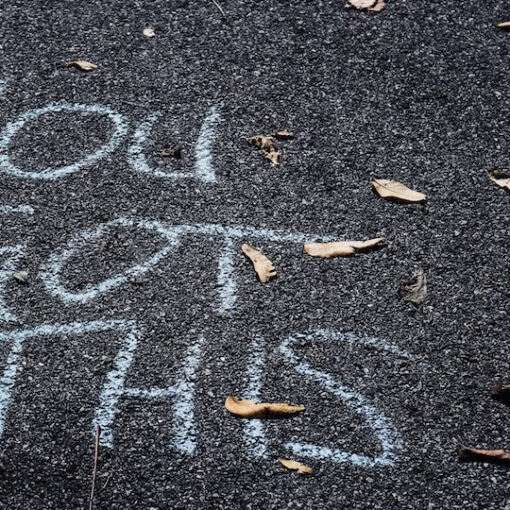

Look, I know life is hard. But life is good. Building a firm that can achieve the eight-figure exit can be frustrating, but it doesn’t have to be. By working diligently to avoid lawsuits and disclosing litigation (should it arise) to your potential buyer, you can make selling your RIA at least financially simple. Hey, let’s go out and make it a great day!

Are you prepared to make the ultimate sale? Want help preparing your firm for the scrutiny of due diligence? Reach out to our team to learn how we could help!

Bitcoin

Bitcoin  Tether

Tether  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  LEO Token

LEO Token