[ad_1]

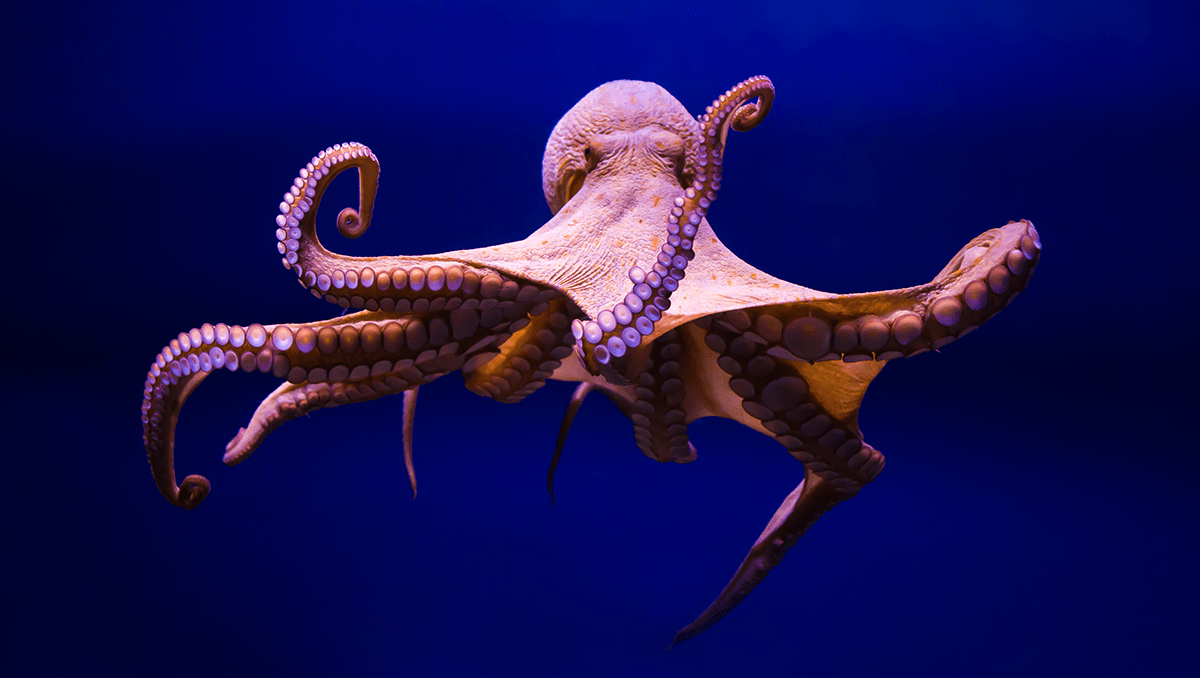

Global private capital firms are charting a well-traveled course. With their sprawling empires, the largest alternative asset managers have adopted strategies that borrow extensively from the octopus-like corporate conglomerate business model.

The Age of Private Market Empires

Many private equity (PE) firms are building product lines that are adjacent if not necessarily complementary to their traditional buyout activities. These product lines all sit under one common umbrella: capital solutions. That is why the moniker “financial conglomerate” now applies.

By aggregating multiple and sometimes loosely related businesses, these modern conglomerates achieve two main purposes: They consolidate market power and diversify away economic risks.

Infrastructure, credit, life insurance, real estate, and venture capital have as much in common today as the General Electric (GE) domestic appliances line had with its aircraft engine production unit, or the General Motors (GM) former subsidiary Frigidaire had with its main automobile manufacturing business. For today’s financial conglomerates, as with their corporate predecessors in the last century, asset accumulation and revenue maximization have taken priority over strategic coherence.

Fifty years ago, buyout pioneers believed corporate conglomerates were overly complex and that corporate carve-outs could create greater value. Yet today, in a bid to shed their reputation as financial engineers, PE fund managers are acting more like industrial owners, holding onto portfolio assets for a decade or longer rather than the conventional three to five years.

They also play a more active role in portfolio management — with operating partners, sector experts, and when needed, turnaround specialists — than they did when they first emerged in the 1970s. Back then, they behaved more like holding companies: They were neither operationally nor strategically involved in the day-to-day running of investee companies. Though established to improve corporate governance and strategic focus, private capital firms now emulate old corporate conglomerates.

But if this is the case, it is worth examining why the practice of vertical and horizontal integration so often led to failure in the past. What went wrong with the corporate conglomerate business model?

The Conglomerate Discount

Conglomeration is a good way to maintain control over family businesses, as Reliance, Mahindra, and Tata, among other firms, have demonstrated in India, and can also help governments set industrial policies in strategic sectors, as with some keiretsu in Japan, chaebols in South Korea, and jituan in China, as well as in much of Europe.

But conglomerates have rarely maximized long-term shareholder value. Too often, whatever synergies they manage to create fail to compensate for the costs associated with the increased complexity. Such conglomerates seek out scope as well as scale, even when they lack expertise in the targeted sectors. In Europe, for example, the now-disbanded Hanson Trust group spanned retail fashion, typewriters, chemicals, gold mining, toys, tobacco, and beyond.

The temptation to devise economies of scope is hard to resist, even when it stretches a conglomerate’s capabilities. Five years ago, the world’s largest telecom operator, AT&T, acquired the WarnerMedia entertainment group, for example, only to unwind the deal three years later.

Like other industrial concerns, GE operated under the principle that centralized strategic planning and capital allocation was the most efficient way to run separate business units. Yet, during the global financial crisis (GFC), its GE Capital financial division faltered and starved the whole enterprise of cash. This helped force the sell-off of its mass media unit NBCUniversal.

Giant corporate conglomerates often hire strategy consultants to help address the challenges posed by their size. Various management fads in the 1980s made way for operational solutions and systems implementation in the 1990s. Under CEO Jack Welch, for example, GE adopted Six Sigma process-improvement methods. But these practices ended up mostly overengineering management structures.

In PE, financial engineering tends to drive investment performance. So, the corporate fixers in financial conglomerates are not management consultants but leveraged finance and turnaround experts, especially in distressed scenarios.

Eventually, the corporate conglomerate came to suffer from a fundamental weakness: The whole was worth less than the sum of its parts, and unrelated divisions were “worth less than if they were stand-alone units,” as Michael E. Porter writes.

The combination of business and market risks led public investors to assess most conglomerates at a discount relative to their breakup value.

Risk Diversification and Return Dispersion

Demergers became the most efficient way to extract the true value of the underlying assets and demonstrated that individual corporations did have an optimal structure. Therefore, the main challenge for modern-day private capital firms is achieving both horizontal cohesion and vertical integration.

Many corporate conglomerates started out by building a dominant competitive position in one or a handful of businesses. Once the strong core was established, they expanded vertically and horizontally. The strategy became so popular that, by 1970, 20% of Fortune 500 companies were conglomerates.

Private capital firms emulated this pattern, first refining their expertise in one or two asset classes — frequently leveraged buyouts, infrastructure, or real estate — before branching out into credit, venture capital, insurance, distress investing, and even natural resources. The rationale behind the emergence of private capital supermarkets is simple: They offer the convenience of one-stop shopping to investors that lack the wherewithal to execute a diversification strategy.

Alleviating performance cyclicality is the obvious benefit of this approach. Diversification across a broad range of uncorrelated asset classes mechanically reduces volatility, as when infrastructure is paired with growth capital or when the steady income flows of the insurance business are counterbalanced by the unpredictable earnings of early-stage financing.

Yet, conglomeration is not an efficient way to reduce investment risk. There is a fine line between diversification and dispersion. After all, investors can likely gain better diversification at lower costs across the entire spectrum of asset classes through an index tracker than by investing in the few assets identified and acquired by a financial or industrial conglomerate’s management team.

Sponsors Benefit More Than Investors

Financial conglomerates are a great way to enrich senior management. Corporate superstructures give the executives in charge enormous influence. That creates agency problems. For asset managers, it enhances “the ability of insiders to expropriate financial institution resources for private gain,” as Luc Laeven and Ross Levine observe. A recent lawsuit filed by Apollo shareholders against senior executives is only the latest case in point.

Corporate heft also provides significant levers for generating supernormal and at times artificial profits. GE’s earnings-massaging techniques under Welch resembled those that deal-doers use to bolster EBITDA with sundry addbacks or manipulate internal rates of return (IRRs).

Sector dominance has also led to questionable market practices. Just as GE, Westinghouse, and other electrical equipment manufacturers colluded to rig prices in the 1950s, several PE fund managers faced accusations of conspiring to reduce price competition in mega buyouts during the mid-2000s credit bubble. In the same vein, both corporate and financial conglomerates have incurred penalties for overcharging clients.

Ultimately, the corporate conglomerate business model succumbed to performance dilution and value erosion. Strong results in one activity did not guarantee success in another. Instead of smoothing out the effects of the economic cycle, conglomeration piled on business and market risks.

GE’s preeminence in aircraft engines and medical equipment did not transfer to computers, broadcasting, or nuclear power. TPG ‘s success in growth capital did not carry over into mega buyouts or in Europe. And UK-based 3i Group’s track record in leveraged buyouts in the 1980s had little bearing on the firm’s efforts in early-stage financing during the dot-com bubble.

“Diversification alone is not a winning investment strategy,” Bain & Company notes in its “Global Private Equity Report 2010.” “There is little correlation between the number of asset classes or geographies in which a firm invests and its overall performance.”

Private Capital Resilience

As of 2010, only 22 true corporate conglomerates remained in the United States. The challenges associated with asset shifting, intra-group profit, and capital structure help explain their near extinction. Moreover, since each division effectively sits under one legal and financial roof, the whole is always vulnerable to any claim against a single business unit.

The standard PE model, by contrast, creates legal separation between portfolio assets and fund management partnerships. Although in Europe this legal framework has, at times, been put to the test, it largely immunizes financial sponsors from any liability at the investee company level.

PE practitioners can also offload most of the financial cost of failure onto third parties — the institutional investors, or limited partners (LPs), whose capital they handle. A fund manager’s commitment is often less than 5% of total assets and directly sourced from the management fees charged to LPs. To quote Bogle once again, “These conglomerates, truth told, are in business primarily to earn a return on their capital, not on the fund investors’ capital.”

Therefore, for fund managers, bringing together diverse activities in multiple asset classes and industry segments makes sense, even if it leads to a lack of focus and financial underperformance.

So, even as GE — one of the most influential and admired US corporations for over a century — prepares to follow the example of ITT and demerge into three separate entities, private capital is unlikely to meet the fate of the corporate conglomerate anytime soon. Unless and until a new model emerges that provides a better alternative, these financial conglomerates could prosper like GE and GM in their prime.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author(s). As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / TheSP4N1SH

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Source link

Bitcoin

Bitcoin  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  LEO Token

LEO Token