[ad_1]

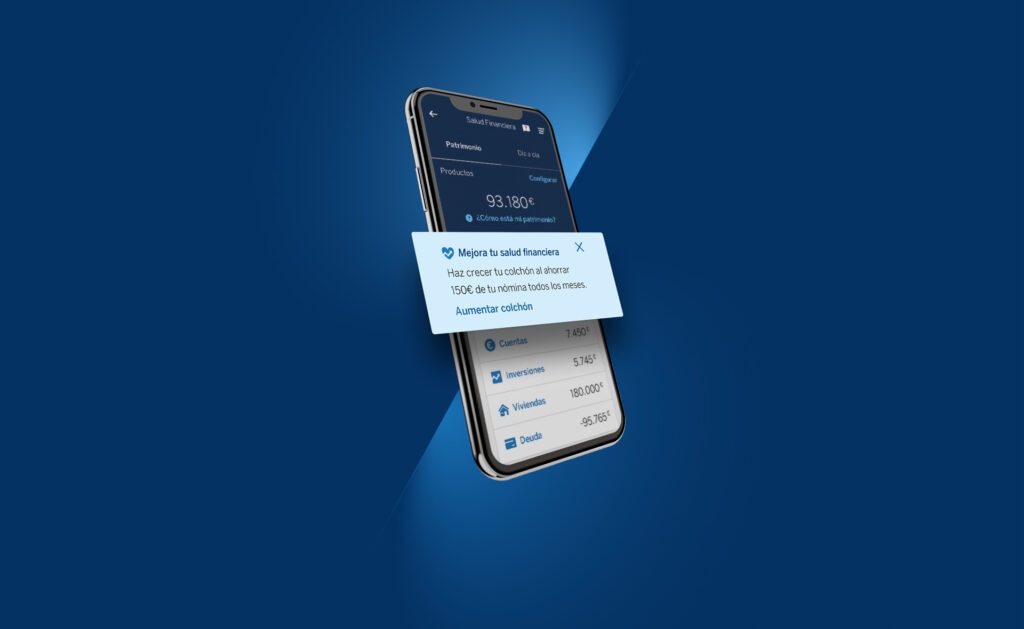

Customers are using these features more and more frequently

Across the BBVA Group, the interactions of the bank’s customers with these tools have increased by 85%, from 12 million in December 2020 to 22,7 million in the same month this year.

By geographical area, the country where these interactions have increased the most is Mexico, where they have grown by almost 220% between December 2020 and 2021, from 2 to 6.5 million. In Spain, the annual increase is around 72%, from 8 to 14 million interactions.

Excellent customer opinions, greater satisfaction and loyalty

BBVA’s tools have not only seen an increase in users and interactions, but are also rated very positively by the bank’s customers. User opinions in Spain have reached an average of 8.67 out of 10 (based on the figures for the last three months). These positive opinions are an example of the increased satisfaction generated by these tools among BBVA customers.

Furthermore, the index that BBVA uses to measure customer satisfaction, known as NPS (Net Promoter Score), for users of financial health tools is 39.2 compared to 29.9 for customers who do not use them.

These customers are more satisfied and, in addition, are more loyal. Thus, the probability of losing customers who use the financial health functionalities is 1.2 points lower than that of non-users.

[ad_2]

Source link

Bitcoin

Bitcoin  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  LEO Token

LEO Token