[ad_1]

Joachim Klement, CFA, is the author of Geo-Economics: The Interplay between Geopolitics, Economics, and Investments from the CFA Institute Research Foundation.

In response to its invasion of Ukraine, Russia has been targeted with severe economic sanctions. How impactful will they be? We have yet to see a serious, data-driven analysis.

Some predict the embargo will initiate a Russian financial collapse very quickly, while others expect it will constitute more of a long and slow drag on the economy.

We wanted to bring some numbers to the table to understand just how long Russia might withstand the Western sanctions regime. We split our analysis into two parts: The first considers the Russian economy’s ability to access dollars and euros and generate domestic revenue to finance the war and other nondiscretionary spending. The second explores whether the reserves stockpiled by the Russian central bank and sovereign wealth fund will be enough to finance these expenses.

International Income: The Trade Deficit

Ironically, the sanctions levied against many Russian commercial banks, investments, and exports mean that to generate revenue in hard currencies, Russia has to become a barter economy.

Under normal circumstances, the country can acquire dollars and euros through foreign investments or by exporting goods and services. The export embargo has made it almost impossible for Russia to generate export revenue just as the sanctions against Russian stocks and other assets have made it impossible to raise capital by issuing stocks and bonds to foreign investors.

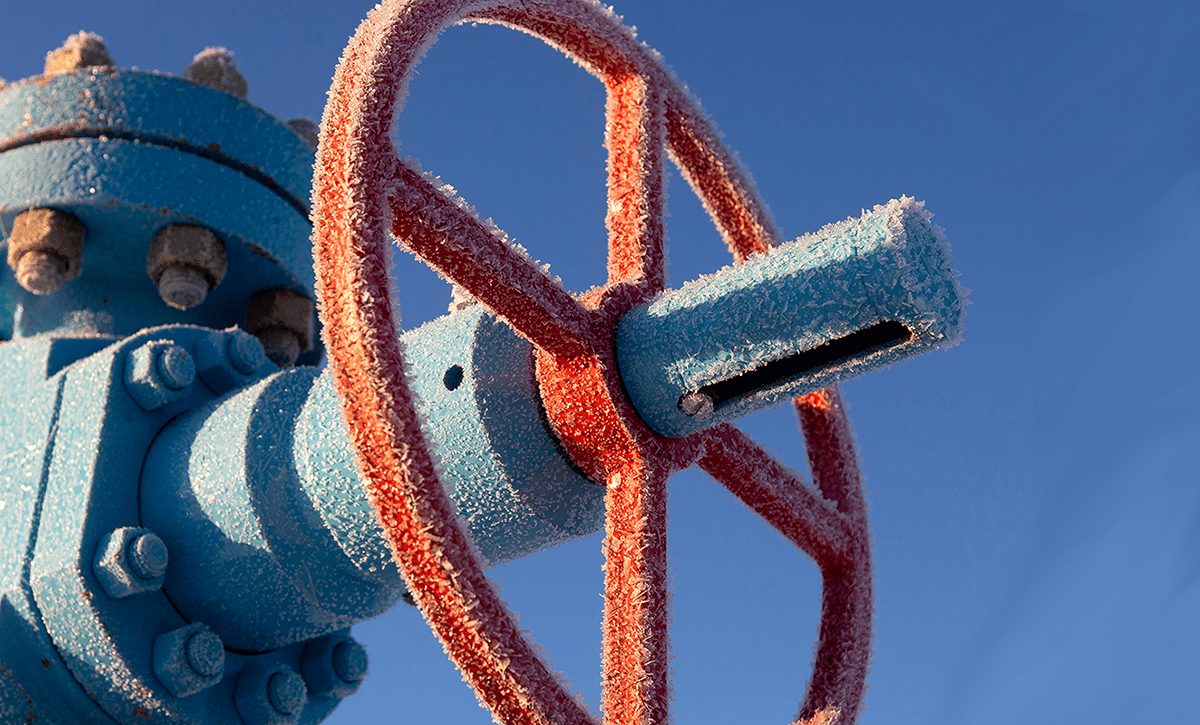

Practically, the only way Russia can obtain dollars or euros is through oil and gas exports and settlement via Gazprombank, one of the few major Russian financial institutions not yet excluded from the SWIFT system. Of course, Russia can channel its oil and gas exports to other countries and receive payment in different currencies, but it will have little leverage when it comes to setting the price, and since such currencies are not freely convertible, dollars and euros will remain hard to come by and in short supply.

This is important because Russia needs dollars and euros to pay for vital imports of food, medicine, and other civilian products. In 2021, Russia’s total exports of goods and services amounted to $493.3 billion, according to Bloomberg data. Oil and gas made up $235.6 billion of that, while metals, coal, and wheat — most of which are now embargoed — accounted for most of the remaining $257.8 billion.

By our estimate, under the sanctions, Russia will be able to export oil and gas and such food commodities as wheat as well as fertilizer chemicals and potentially cotton and wood products. But with fewer imports from the West, internal Russian demand for these commodities — wheat, in particular — will increase. So, much of what’s produced will likely have to be directed for domestic use rather than sold abroad. In the end, Russian non-oil and gas exports will probably be reduced to some $25 billion.

So, if we ignore the current buyer’s strike and the potential for further sanctions on energy exports and assume Russia finds a market for its oil and gas, the country will have $260 billion in total exports this year. That’s a decline of around 48%.

Meanwhile, Russia’s total imports of goods and services were $293.4 billion in 2021, according to Bloomberg. Of this, around $10.6 billion was food, $9.4 billion was clothes and shoes, and $9.7 billion was medicines and antibiotics. The lion’s share — $144.3 billion — was machinery and equipment. If we exclude passenger cars, furniture, and other nonessential goods from the import list but keep machinery imports at current levels, Russia’s total imports are likely to drop to $270 billion.

Thus, Russia faces a trade deficit of some $10 billion to $20 billion that must be financed. Of course, the more machinery imports are reduced due to sanctions, the more the deficit is reduced and eventually turned into a surplus, reducing the funding needs of the Russian government.

$488 Billion in Hard Currency?

The trade deficit aggravates the challenge for Russia. Beyond what it will have to pay for essential products, the country, in theory, needs to service its debt and finance the war. That is going to be expensive.

The Russian invasion of Ukraine cost $7 billion in just the first five days, according to Centre for Economic Recovery analysis. This includes an estimated $2.7 billion loss in GDP from the estimated 6,000 Russian casualties. Excluding the toll in human capital, that’s $4.2 billion in less than a week. Over three months at the same rate of expenditure, the cost to the Russian military in materiel alone would amount to roughly $50 billion.

External debt is another compounding factor. The Russian Federation held $490 billion in external debt in 2021, according to Bloomberg. Of this, $67.7 billion was Russian government debt and $78.5 billion was bank debt. Total debt service on this $490 billion fluctuates around $100 billion per year. Total debt service on Russian government debt in 2022 will add up to $7.3 billion and will rise to $10 billion in 2023.

Thus, for the nine months left in the year, Russia will need to finance a trade deficit of $7.5 billion to $15 billion, $7.3 billion in external debt just on government bonds, and roughly the same amount in bank debt. Finally, Russia will need $50 billion or more, depending on how long the conflict lasts, to pay for its military operations, much of which will be owed to domestic defense contractors who will be paid in rubles.

To cover these costs, Russia will have to access the reserves of its central bank and its sovereign wealth fund, the National Wellbeing Fund. At the end of 2021, the Central Bank of Russia had $630 billion in international reserves, according to Bloomberg, with roughly $468 billion in foreign currency and $132 billion in gold. Of the foreign currency, 61.3% is held by G7 central banks, the IMF, and the Bank for International Settlements (BIS). The sanctions have frozen all of that 61.3%. Since the gold reserves are held domestically, the Central Bank of Russia still has access to the $132 billion as well as the remaining $181 billion in foreign currency reserves. The National Wellbeing Fund has another $174 billion in available reserves, while the Russian government has some $488 billion in available hard currency.

From there, the purely financial calculus is elementary: Russia still has sufficient assets to fund the war and survive the sanctions for the next several years.

Of course, this is just the headline number. The economic sanctions will dramatically reduce economic output and with it business and government income. The Russian Federation had $329 billion in total government expenditures last year at the late 2021 exchange rate. The current embargo will reduce Russian GDP by around 9.5% annually, assuming oil and gas exports remain in line with those in 2021, according to analysis by the Kiel Institute for the World Economy. This implies that tax revenues will drop by about $18 billion — which isn’t a huge sum compared with the available reserves. But if Russia can’t export its oil and gas, it will have to compensate for an additional revenue shortfall of $120 billion.

The conclusion of all these calculations is simple: As long as Russia can continue to export oil and gas, it can finance the revenue shortfalls generated by the sanctions for a long time. But the economic toll will be enormous: GDP will drop nearly 10% over the next 12 months alone and may not stop there.

But if Russia loses its oil and gas revenues, it will run out of money within one to two years.

For more from Joachim Klement, CFA, don’t miss Risk Profiling and Tolerance and 7 Mistakes Every Investor Makes (and How to Avoid Them) and sign up for his regular commentary at Klement on Investing.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Bloomberg Creative

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Source link

Bitcoin

Bitcoin  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  LEO Token

LEO Token