[ad_1]

The 2024 Baselane Real Estate Investor Survey reveals optimism among investors despite rising costs. Key takeaways include:

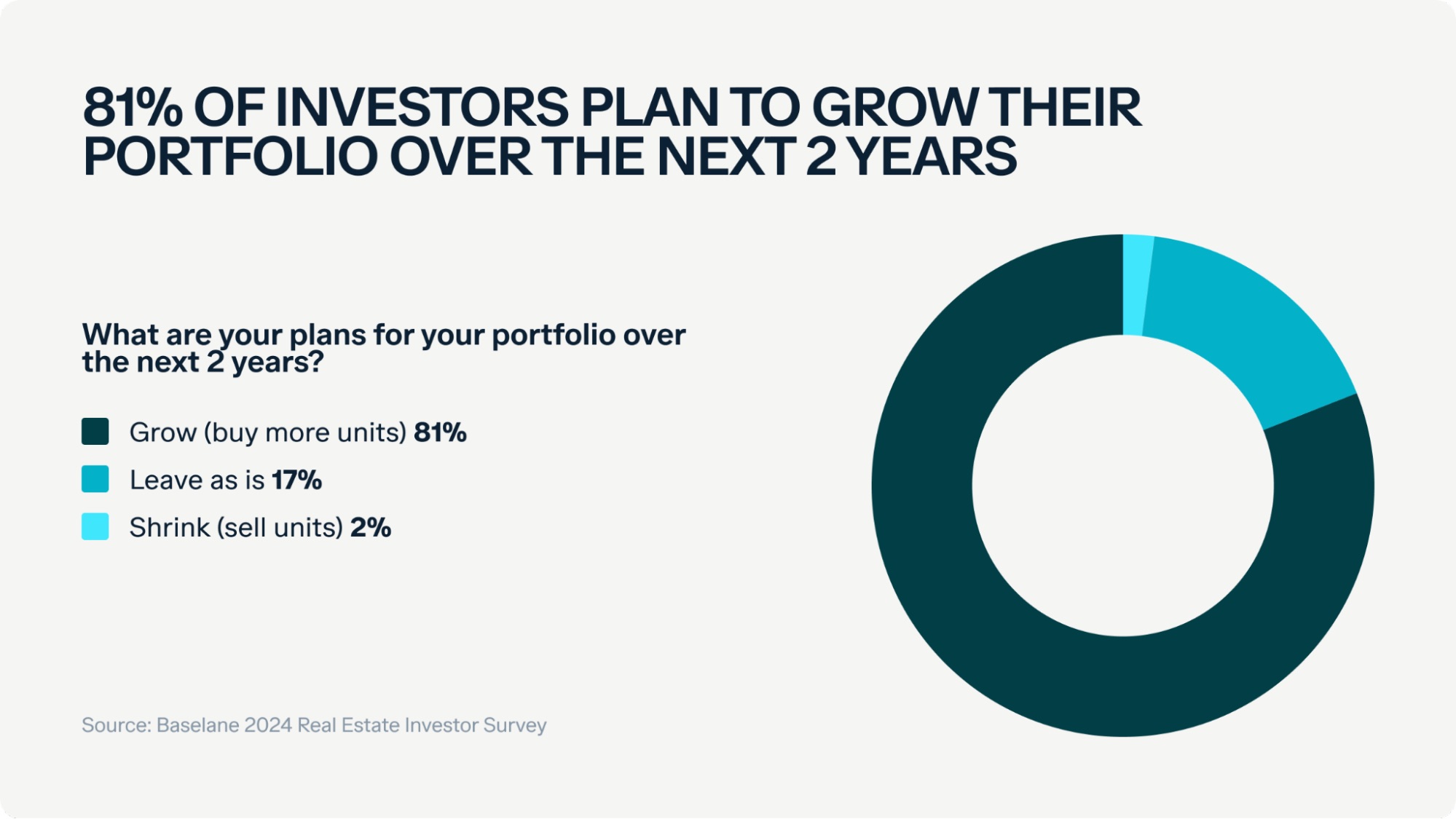

- 81% of investors plan to grow their portfolios within two years.

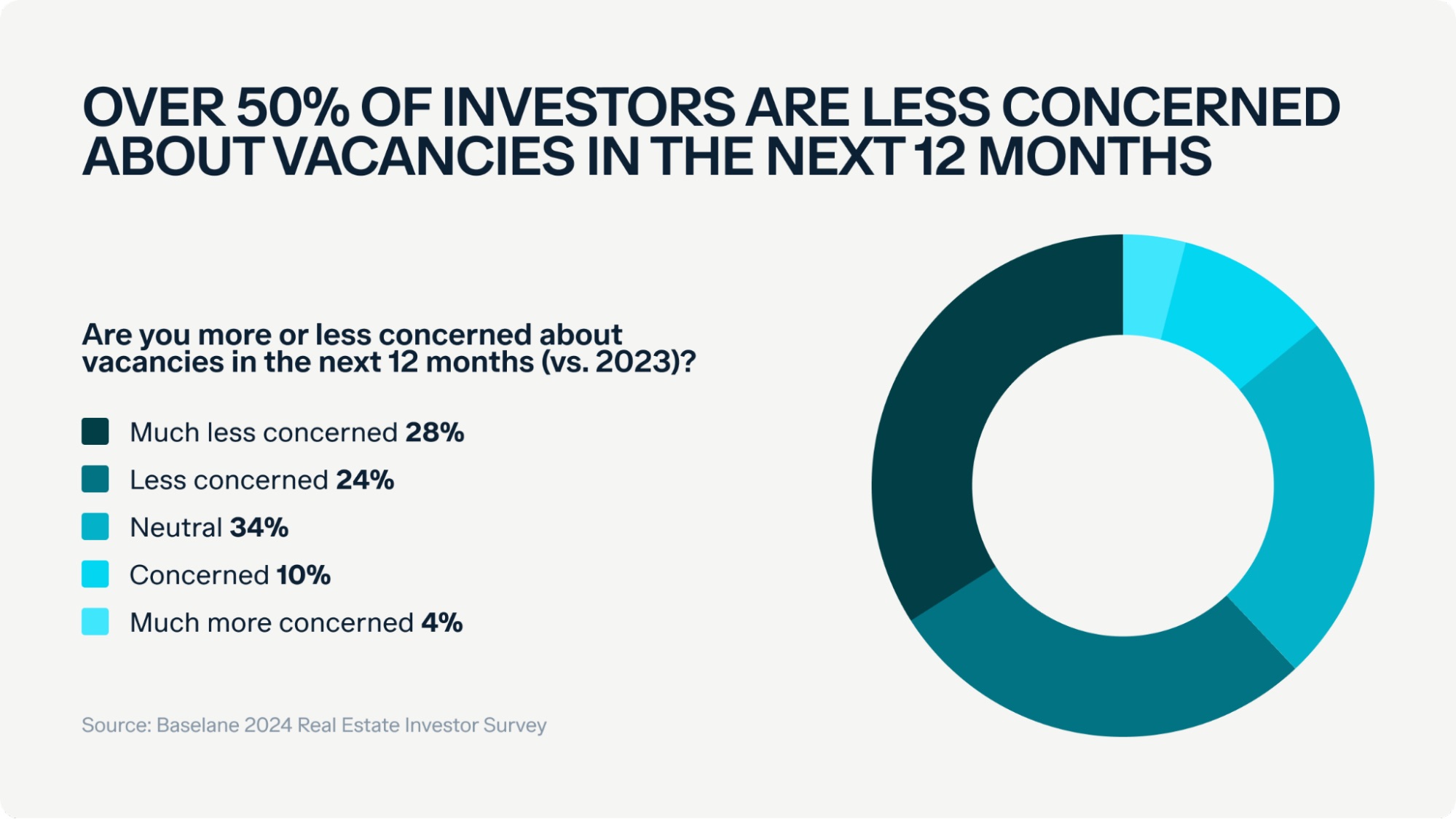

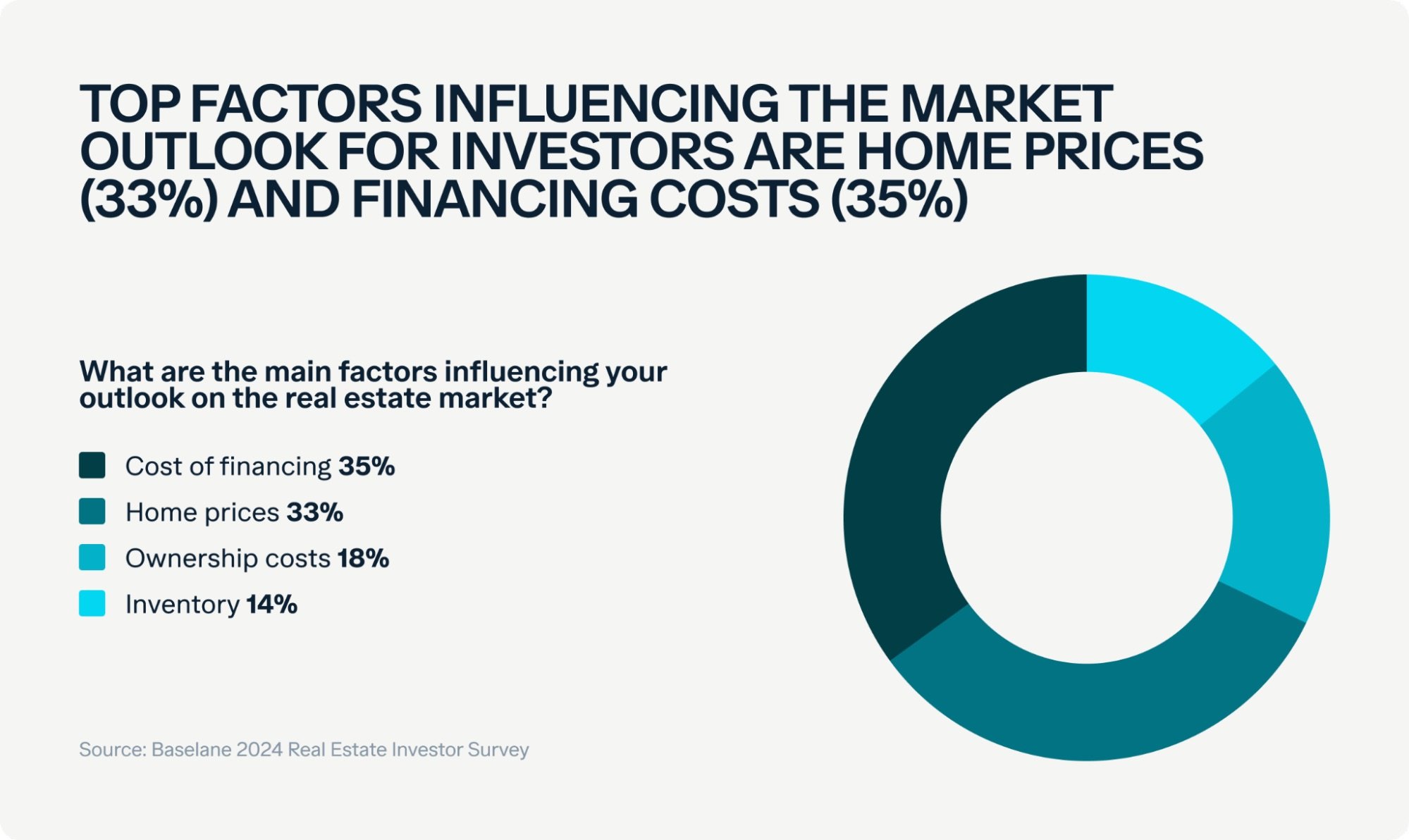

- Investors are less worried about vacancies, focusing on financing costs (35%) and home prices (33%).

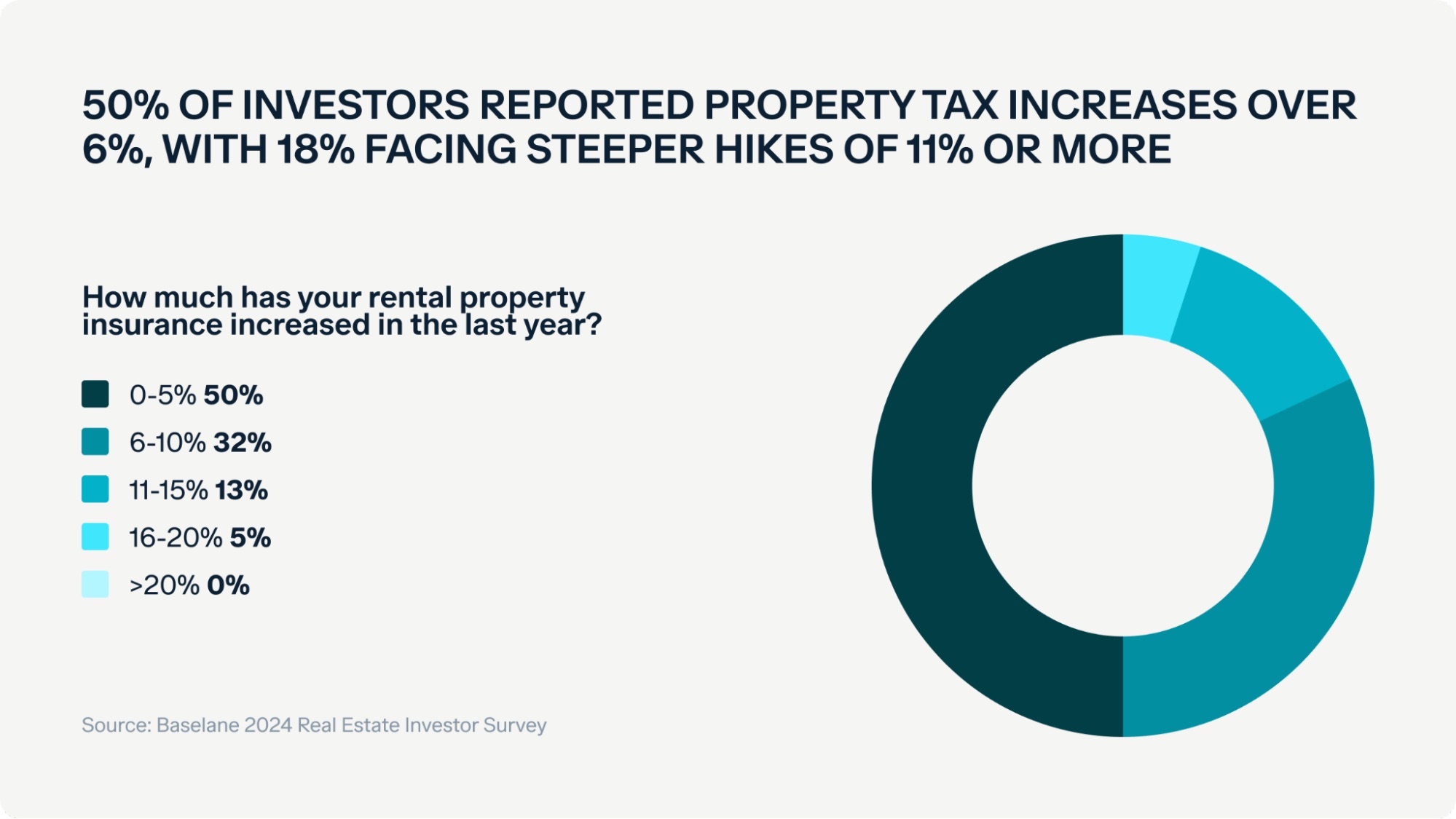

- 22% faced rental insurance hikes of 11% or more, and 50% saw property tax increases of over 6%.

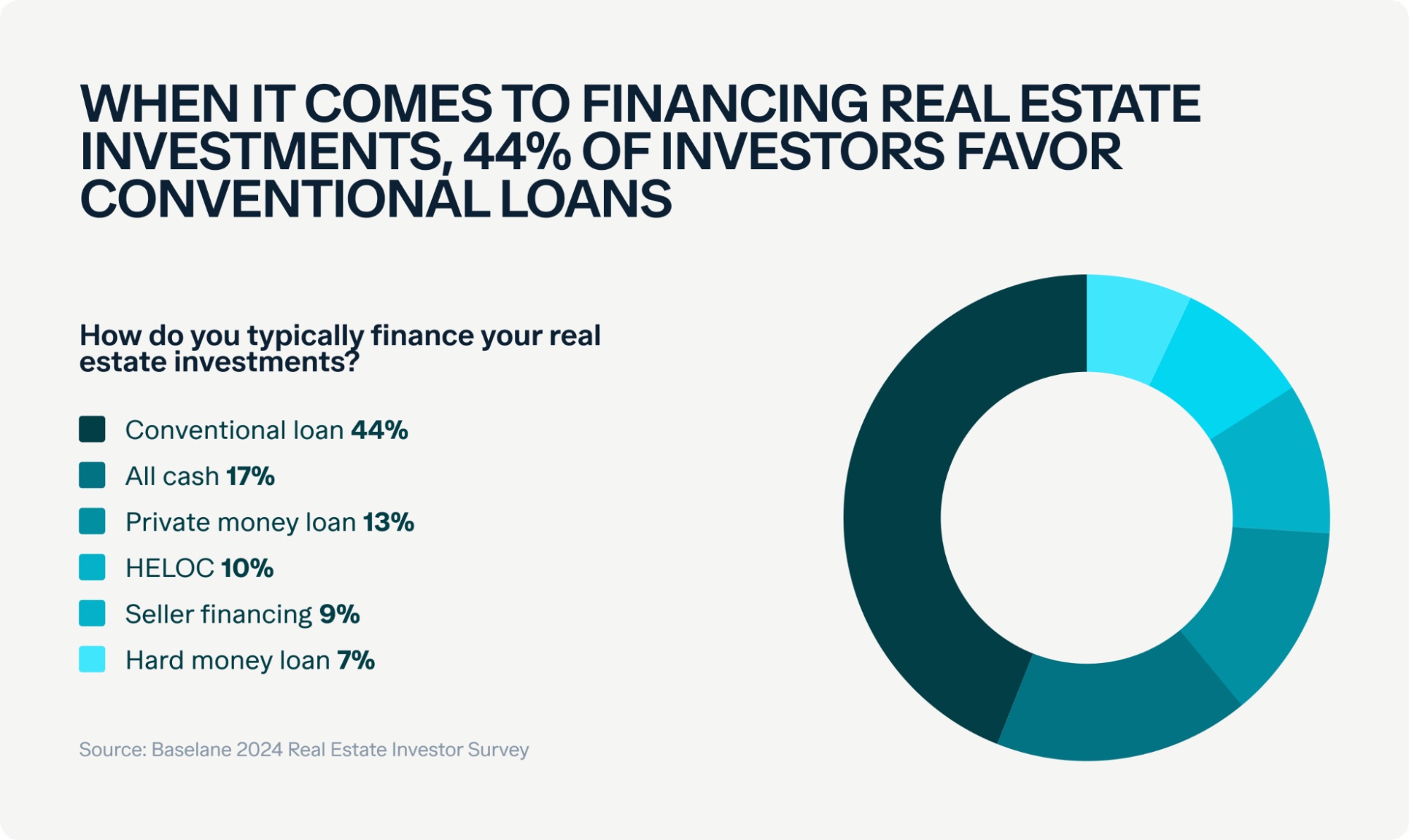

- Conventional loans remain the top financing option (44%).

Investors Are Growing Portfolios But Skeptical

No, the sky is not falling on real estate investors, and they are not waving the white flag. I agree that transactions may be down, but that doesn’t mean that investor sentiment is changing. Over 81% of investors are intending to grow their portfolio over the next two years, according to a recent investor survey by Baselane.

After reading through the survey, it became clear that investors are optimistic but cautious when underwriting deals. Indeed, 17% of investors felt comfortable with their portfolio and did not feel the need to expand anytime soon.

As rental demand stays steady, vacancy concerns have dwindled, as over 52% of investors are less or much less concerned about them than in 2023.

Affordability Is at the Forefront

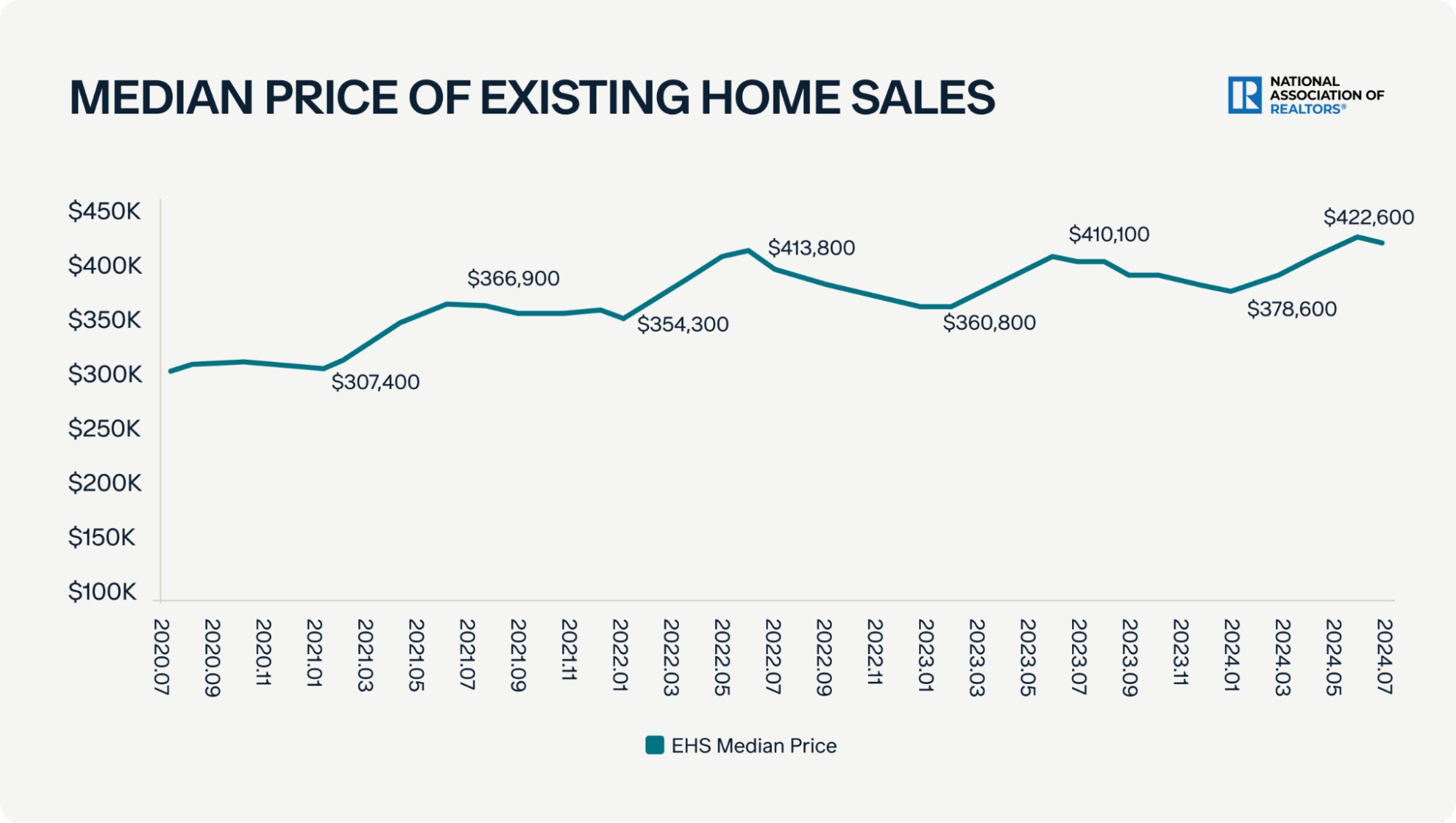

Getting tenants in does not seem to be the issue, but financing and rising home prices that rental rates can’t keep up with are. According to the National Association of Realtors (NAR), the median home price for July 2024 has risen 4.2% year over year (YoY) to a whopping $422,600. The explosion over the last four years is quite staggering when you consider most sales during that time were made with interest rates below 3%.

Potential sellers’ mortgages are at their pandemic interest rates, and so they are locked in and not letting go, understandably. That same reason leaves buyers on the sidelines waiting, hopefully, for rates to drop.

Data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development shows that as of August, housing starts for privately owned homes have decreased by 6.8% since June and 16% compared to July 2023.

Insurance, Taxes Are Concerns

If you have owned a house over the last few years, you probably have seen insurance costs going through the roof (pun intended) and taxes pacing the rising home prices. Nearly a quarter (22%) of those surveyed saw rental property insurance hikes of 11% or more, and 13% experienced increases over 20%.

Taxes are going higher than the Smoky Mountains, with 50% of investors seeing increases over 6%, and 18% facing rises of 11% or more.

Conventional Financing Is Still King

As for financing real estate investments, 44% of investors stick with conventional loans, like they’re the comfy sweatpants of the real estate world—reliable and familiar. This choice blows other options out of the water, such as all-cash purchases (for those who’ve found a hidden treasure chest), private money loans, HELOCs, seller financing, and hard money. Clearly, most investors like to keep things simple with the old faithful of property buying.

Rates have finally seen some relief, with a current rate of 6.2%, the lowest since February 2023. This is a dramatic swing from the highs of 7.79% in 2023, with investors hoping to move further from that number.

Financing, Home Prices Top Priorities

With mortgage rates likely staying around 6% next year and the housing market not balancing supply and demand until 2025 (or beyond), it’s no surprise that financing (35%) and home prices (33%) are major concerns for investors.

Adding to investors’ worries is the growing presence of institutional investors—those snapping up 1,000 properties a year. Their large-scale buying can drive up prices in certain areas, making it challenging for local investors to compete. This trend was evident in Q1 2024, with 18.7% of U.S. homes sold to institutional investors—the highest percentage in almost two years. These homes were flipped for an average hefty 55.2% profit, up from 46.3% the previous year.

On the other hand, limited housing supply and skyrocketing home prices are boosting rental demand. Currently, renting is 27% cheaper than buying in all 50 largest metro areas. As more people get priced out of homeownership, they turn to renting, creating an opportunity for independent investors to tap into this demand and increase portfolio returns.

Final Results

Although the rising costs of buying and maintaining rental properties can be challenging for some, they also reflect the strength and stability of the real estate market. As one investor said, “Real estate is always a solid investment—you just need to find the right property.”

Research Methodology

Baselane conducted an online survey of U.S. landlords and real estate investors within our network from June 18-26, 2024. We surveyed approximately 2,116 investors and continued collecting responses until reaching a response rate of over 10%, ensuring a statistically significant sample size.

This landlord survey aimed to gather critical insights into investment strategies, financing preferences, property ownership costs, and expectations for the future of the real estate market. To maintain the accuracy and relevance of the data, we used neutral, non-leading questions and applied branching logic to display or hide questions based on previous responses. The sentiment was measured using a 1-5 scale, ranging from “Strongly Disagree” to “Strongly Agree.”

Find the Hottest Deals of 2024!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link

Bitcoin

Bitcoin  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  LEO Token

LEO Token